Joint ventures don't have to be complicated. Here's the framework that actually works.

Hi everyone. Today I want to break down one of the most misunderstood aspects of real estate investing: how to structure joint venture deals fairly. This question came from one of my top students who's already closing his fourth deal, so I know it's something many of you are thinking about too.

Hi Dan, I’ve been thinking about creative ways to finance deals, especially JVs. My question is, how do you decide the best way to split a JV so it’s fair and both sides win?

For example, if one person finds a good deal and brings someone else in, how do you decide who gets what? How do you make the numbers work so that it’s a win-win?

I heard one podcast that said there are four parts: the person who finds the deal, the one who gets the loan, the one who manages the renovation, and the one who brings the down payment. Each person should get their share, but they didn’t say exactly how much.

So, what do you think is the right way to divide things up in a JV?

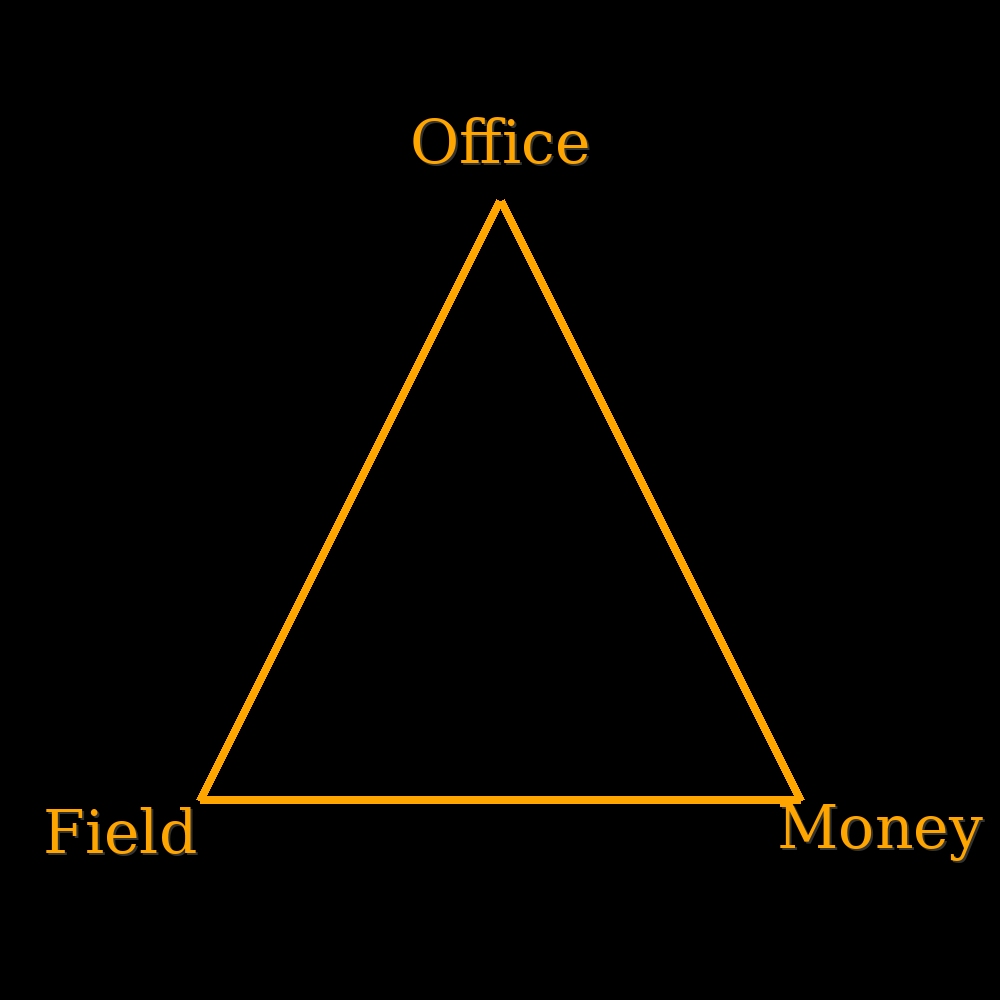

The Triangle

Most people overcomplicate JV structures. Instead, think of every real estate deal as a triangle with three essential points:

1. The Deal Sourcer (Office)

2. The Money Partner

3. The Field Operations

You need all three to make a deal happen, but they're not created equal.

The Deal Sourcer: The Power Position

Here's the truth nobody wants to say out loud: the deal sourcer holds the strongest negotiating position. Why? Simple math.

- No deal sourcing = no deal at all

- No money partner = find another money source

- No field operations = hire different contractors

The deal sourcer has multiple options for every other position, but without that initial deal, there's nothing to structure.

How Deal Sourcers Get Paid

The beauty of being the deal sourcer is you can get paid at three different stages:

1. Upfront Finder's Fee: $2,500 minimum (can go up to $15K+ for exceptional deals)

2. During Management: 5% of gross rental income if you're managing the managers, or 10-20% of net profit

3. At Sale: 10-60% of profit depending on your involvement level

For flips where you're heavily involved, 50% of profit is standard when your partner brings all the money.

The Money Partner: Predictable Returns

Money partners care about two things, in this order:

- Return OF investment (getting their money back safely)

- Return ON investment (profit percentage)

Typical money partner returns range from 6-14%:

- Banks: ~6% (30-year mortgages)

- Private investors: 7-12%

- Hard money lenders: 14-16%

Money partners can structure their returns as:

- Fixed percentage: Guaranteed return regardless of deal performance

- Performance-based: Percentage of actual profits (higher risk, higher reward)

Field Operations: Fixed Costs, Not Profit Shares

Here's where I disagree with most "gurus": field people don't get equity stakes. They get paid for services rendered.

- Contractors get paid per project

- Property managers get management fees

- Real estate agents get commissions

Field operations are expenses, not profit-sharing partners. They're crucial to execution but don't share in appreciation or long-term gains.

Negotiation Trumps Formulas

Here's what most content creators won't tell you: there's no magic formula because everything comes down to negotiation.

The percentages I've shared are starting points based on market standards, but your actual deal depends on:

- Quality of the opportunity

- Scarcity of good deals in your market

- Relationships with your partners

- Risk tolerance of all parties

Real-World Example

Let's say you find a property for $50K that's worth $120K after $10K in renovations:

Option 1 (Wholesaler approach): Take $20-30K finder's fee and walk away

Option 2 (Long-term approach): Take smaller finder's fee ($5-10K) but negotiate 30-50% of profits at sale, plus ongoing management fees

The second option builds wealth over time and leverages real estate appreciation.

Why I Don't Like "Creative Financing"

Let's drop the fancy terminology. There's nothing "creative" about structuring deals properly. We're just trying to get deals done with the resources available. Call it what it is: smart business.

The Bottom Line

The best position in any real estate deal is the deal sourcer. Master deal finding, and you'll never lack for money partners or field operations support.

But remember — you can have multiple partners within each triangle point. If deal sourcing feels overwhelming, bring in a partner and split that portion 50/50. The key is getting started and learning through actual deals, not endless theorizing.

Stop overcomplicating this. Find a good deal, structure it fairly using this triangle framework, and negotiate from there. That's how real wealth gets built in real estate.

Want to dive deeper into deal structuring? Drop your questions in the comments below, and I might feature your question in a future post.

Keep investing wisely.

- Dan Shimony

International Real Estate Investor